January 16, 20According to Canalys’ latest research, worldwide smartphone shipments grew 8% year on year in the fourth quarter of 2023, reaching 320 million units. This ended seven consecutive quarters of decline.

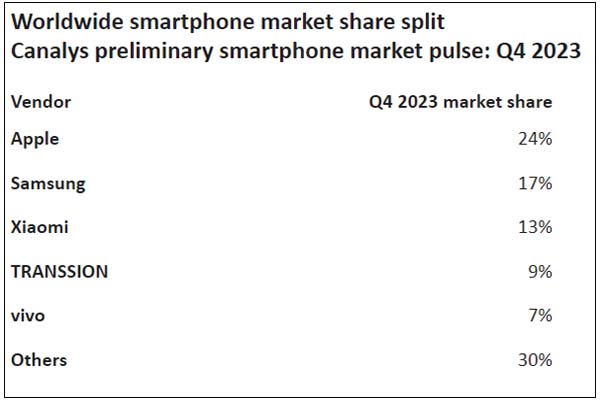

Apple led the market in the fourth quarter with a 24% share of shipments, thanks to new iPhone launches. Samsung took second place with 17%. Xiaomi was third, with over 20% year-on-year growth in Q4. TRANSSION rose to fourth place for the first time, benefiting from emerging market recovery. With a 7% market share, vivo completed the top five. For full-year 2023, global smartphone shipments reached 1.1 billion units, a 4% decrease from the previous year.

For the first time, Apple pipped Samsung to become the year’s top vendor in terms of shipments, though both rounded to 20% shares. Xiaomi, OPPO and TRANSSION held 13%, 9% and 8% shares, respectively.

“The market is heading in the right direction, aided by improved holiday season demand,” said Canalys Senior Analyst Toby Zhu. “Products in the mid-to-low-end price range are the growth drivers in this recovery wave, helped by a rebound in demand in emerging markets, such as the Middle East and Africa, Asia Pacific and Latin America. Meanwhile, with inventory pressure and global inflation continuing to ease, vendors can finally focus on product innovation and long-term strategy developments, laying down solid foundations for the year ahead. There have already been plenty of new flagship Android launches taking advantage of the on-device AI trend, from Google Pixel and several Chinese vendors, such as HONOR, OPPO, vivo and Xiaomi.”

“The top two players are eagerly looking for new growth drivers for their smartphone businesses as both suffered market share declines in Q4,” said Canalys Research Manager Amber Liu. “In 2023, Samsung focused on the mid-to-high-end segment for profitability but lost share in the low-end segment and also its leading position in the global market. Its 2024 product launches, especially in the high-end segment with a focus on on-device AI (see Canalys blog: “On-device AI and Samsung’s role in the future smart ecosystem race”), will support its rebound as an innovation leader in 2024.”

“On the other hand, Apple showed resilience over the past two years, thanks to solid ongoing demand in the high-end segment. The expanded positioning of its iPhone 15 series has pointed to the future direction of Apple’s portfolio strategy to reach a broader range of consumer segments,” said Liu. “But Huawei’s improving strength and looming local competition in mainland China will challenge Apple to sustain its growth trajectory in mainland China while high-end replacement demand in other major markets, such as North America and Europe, is leveling off. Apple must look to new market growth and ecosystem strength to reinvigorate its iPhone business.”