Privatization not expected to affect the operation of India-based traders.

HONG KONG, February 25, 2012 – The world’s largest B2B operation, China-headquartered Alibaba.com, is to go private. The majority owners Alibaba Group which with friendly parties control over 73 of the company, have offered to buy out the remaining minority shareholders at HK$13.50 per share -- the same price that was ruling when the company first went public in 2007. This is almost 60 percent higher than currently ruling prices of Alibab shares in the market.

The company says it is going private to provide minority shareholders an opportunity to realize returns while Alibaba.com implements a shift in its new business strategy that may slow down growth.

Alibaba.com’s business in the early years was driven by a focus on rapidly increasing the number of manufacturers, trading companies and wholesalers that pay a subscription fee to sell products on the company’s marketplaces in order to maximize revenue growth. Last year, the company implemented a major initiative toward improvements in the quality of the buyers' experience on the company’s online marketplaces. As a result the pace of adding paying customers has been slowed down. In previous disclosures, Alibaba.com outlined this strategic shift, warning investors that despite confidence in the favorable long-term prospects of these initiatives, there would likely be a short- to medium-term impact on financial results.

“Taking Alibaba.com private will allow our company to make long-term decisions that are in the best interest of our customers and that are also free from the pressures that come from having a publicly listed company,” says Jack Ma, founder, chair and CEO of Alibaba Group and Board chair of Alibaba.com. “With this offer, we provide our shareholders a chance to realize their investment now at an attractive cash premium rather than waiting indefinitely during this period of transition.”

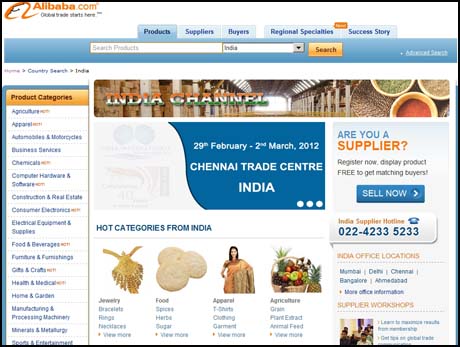

Alibaba.com Alibaba Group's flagship company and the world's leading B2B e-commerce company. India has been one of its fastest growing regions, second only to the US for the number of registered traders. However the privatization is not expected to affect the operation of India-based traderswww.alibaba.com