New Delhi, May 31 2017: The tablet market in India is not growing -- in fact it shrunk marginally by 2.2 percent in the first three months of this year, find according to the latest IDC Quarterly Personal Computing Device Tracker. Some 701,000 tablets were shipped in India in CY Q1 2017, against 716,000 units in the previous quarter.

Tablet shipments in the consumer segment also declined 28 percent in Q1 2017 compared to the same period last year and resulted in a sharp 18.6 percent year-on-year (YoY) drop in total tablet shipments in India. However commercial users may come to the rescue:

This segment accounted for one-third of total tablet shipments in India. Says Celso Gomes, Associate Market Analyst, Client Devices, IDC India, "The commercial segment is the key driver for offsetting the declining consumer shipments in India. Due to growing digital proliferation across industries, commercial segment especially large enterprise, government and education sectors, are expected to increase their demand for tablets. This will drive vendors to focus more aggressively in gaining market share in the commercial market to sustain the India tablet market."

Here are other trends in Q1 2017:

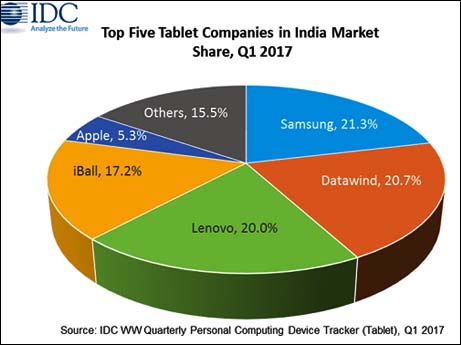

Leading Tablet players

Samsung: Samsung leads the tablet market at 21.3 percent market share. Samsung shipments increased 4.0 percent quarter-on-quarter (QoQ) in CY Q1 2017, primarily due to healthy growth in commercial shipments. Samsung's Galaxy J Max continues to be the top selling model for the company driven primarily by consumer segment, followed by Galaxy Tab A.

Datawind: Datawind secured the second position with 20.7 percent market share. Although shipments grew by 16.7 percent from the previous quarter, shipments are down 38.9 percent over Q1 2016. Datawind's slowdown is primarily due to demonetization in Q4 2016 and partial transition in channel operations from third party television sales to setting up its own TV home shopping channel.

Lenovo: Lenovo placed third with 20.0 percent market share as shipments remained stable over previous quarter. Two-third of Lenovo's shipments in Q1 2017 went to commercial segment.

iBall: iBall maintained its fourth place standing with 4.7 percent QoQ in Q1 2017. With increased participation in commercial deals, iBall is expected to gain momentum in commercial segment while most of the other key India vendors continue to be consumer oriented.

Apple: Apple maintained its fifth-place position despite shipments declining by 38.2 percent compared to previous quarter. iPad Air 2 remained the top selling model for Apple constituting more than half of its total shipments in Q1 2017. Limited shipments of iPad mini, which accounted for over one-third of total shipments last quarter, would result in shrinking of iOS market in India.

The upcoming GST regime is likely to cast a shadow in the second quarter of 2017: The distribution channels for tablets will be cautious on procuring new inventory especially in the month of June. "Apprehensions on lower tax credit and lack of complete clarity regarding the processes are the major concerns of retailers and city/state level distributors, which may lead to a limited inventory stocking, especially in the June 2017. But impact is expected to be short spanned as channel would prepare themselves for the festive season in second half of Q3 2017," says Sr Manager, IDC Navkender Singh.